Election Information

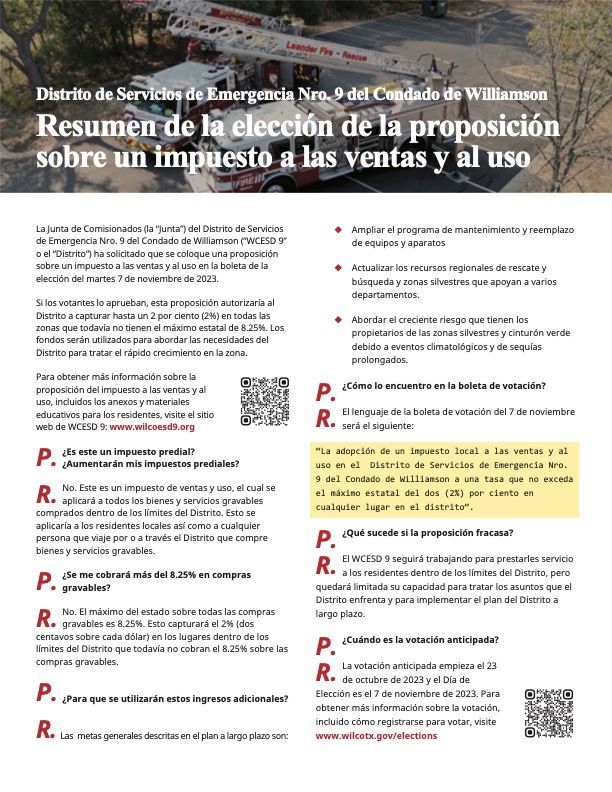

Below you will find important information about the Special Election On the Issue of Adoption by the District of a Sales and Use Tax Pursuant to Chapter 775, Health & Safety Code.

What is a sales and use tax?

Texas imposes a 6.25% state sales tax on all retail sales, leases and rentals of most goods, as well as taxable services. Local taxing jurisdictions such as cities, counties, special purpose districts, and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent.

For Information on Voting Schedules and Locations please use the below link.

ADDITIONAL RESOURCES

Mailing and Physical Address:

402 A West Palm Valley Blvd

Suite 360

Round Rock, TX 78664

Phone:

(512) 479-9267

email:

support@wilcoesd9.org

All Rights Reserved | Williamson County ESD 9 | Copyright